What is EPR?

Extended Producer Responsibility (EPR) is the concept that brands, plastic packaging producers and importers should take responsibility for the plastic they put into a market across its entire lifecycle. EPR policies are based on the “polluter pays” principle and are generally implemented by governments via a set of rules and targets.

EPR programs take one of two forms: those with mandatory targets and penalties for not meeting targets; and those with non-binding targets but with a legal requirement for brands to report on their mitigation performance. The latter is sometimes a stepping-stone towards a more comprehensive, mandated EPR framework.

So if you’re a company selling plastic-bottled mineral water in a country that has a mandatory EPR framework, you’ll probably be required to meet certain collection, recycling and possibly post-consumer recycled (PCR) content targets for your plastic packaging. This means organising your local supply chains and / or working with collection and recycling organisations (sometimes called producer responsibility organizations) to meet these targets.

Why EPR? The plastic pollution problem

EPR is all about addressing the global plastic pollution problem across the product lifecycle. Based on current recycling rates, out of the 460 million tonnes of plastic produced each year, 9 percent is recycled, 19 percent is incinerated, 50 percent goes to landfill, and 22 percent is leaked into the environment (OECD Global Plastics Outlook 2022). This leakage adversely affects human and animal health, air and soil quality, and ocean carbon sink capacity as it breaks down into microplastics. A well-designed EPR framework incentivises plastic packaging producers towards product stewardship via circular production systems and reusable product design which reduce this environmental leakage. It also provides incentives for stakeholders to establish deposit return and take-back schemes.

And a well-designed EPR framework will have clearly defined mandatory targets covering a range of plastic types which scale up over time and are accompanied by robust enforcement mechanisms. Revenue collected from non-compliance penalties will be used to improve plastic waste management infrastructure. EPR frameworks can contain end-of-life plastic disposal requirements and should be synchronised with other circularity-focussed EPR law and legislation such as single-use plastic bans.

Which countries have EPR frameworks?

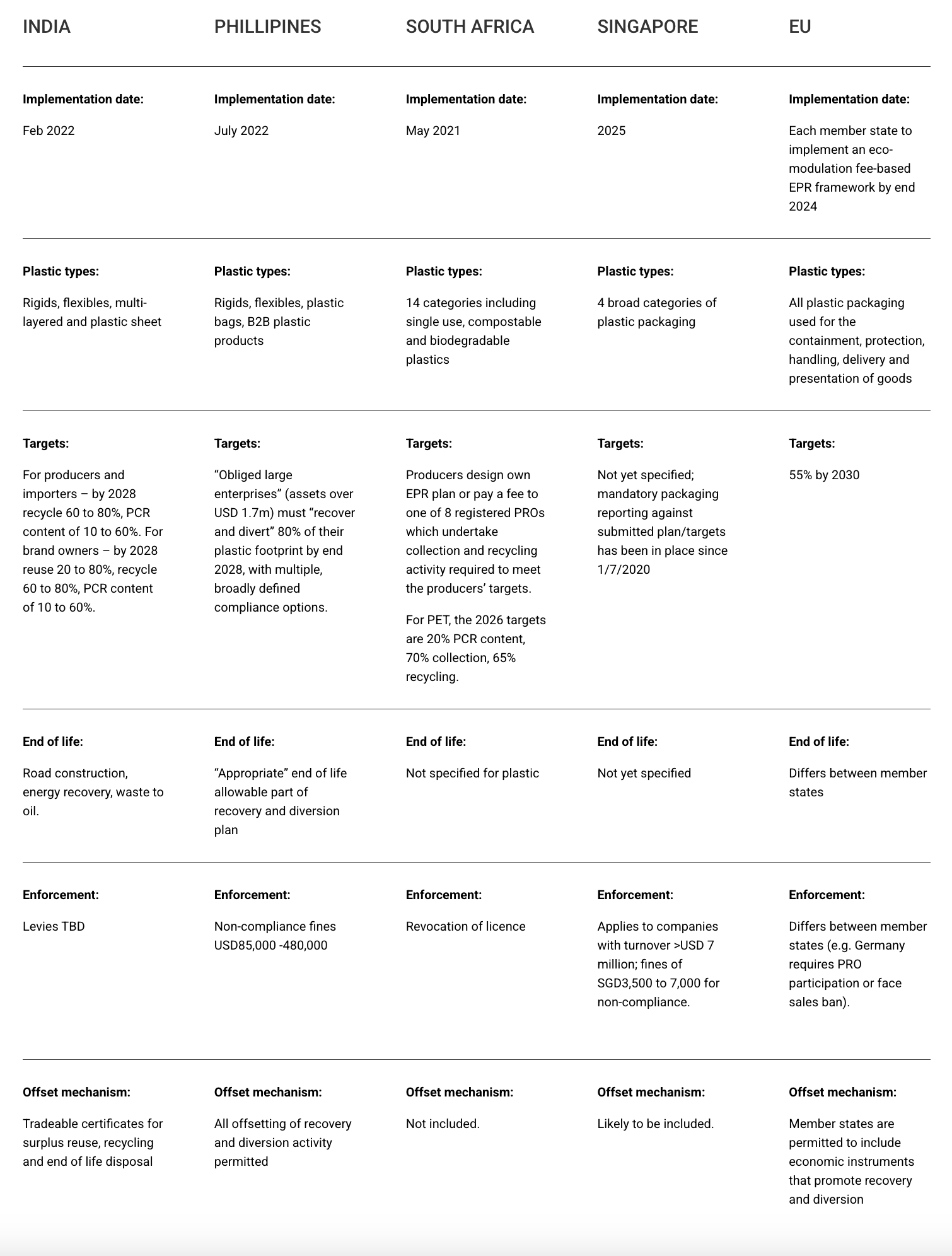

There are now over 70 countries with some form of plastic EPR system in place or under development to help reduce the environmental impacts of producing and using retailer / consumer products and associated packaging material. A snapshot of the EPR schemes and policy approaches in the Philippines, India, Singapore, the European Union (EU) and South Africa is presented in the table below.

What’s really interesting is how these national EPR frameworks for environmental protection might ultimately complement and intersect with global initiatives such as the Verra Plastic Waste Reduction Standard and the United Nations Global Plastic Treaty.

Plastic Standard

Let’s start with the Verra Plastic Waste Reduction Standard. This global standard enables certified plastic waste collection and recycling programs to generate tradeable plastic credits, the revenue from which may be used to fund project scale-up (check out our blog on how plastic credits work). The requirements for certification are rigorous – so a brand / producer partnering with a certified project to help meet its EPR targets will have peace of mind that the project is independently audited, has no child labour, pays living wages, has engaged with stakeholders, and yields community-co-benefits. Certified projects also submit volume monitoring reports on a regular basis which might also be used to meet EPR reporting requirements.

From a brand perspective, Plastic Standard certification can offer a point of differentiation – it’s a signal that it goes beyond what is required to comply with the local EPR rules by being independently certified under a globally-recognised standard as part of its plastic product stewardship journey.

In addition, the certified project may generate tradeable collection and / or recycling credits that are recognised under some EPR frameworks (see table below) as a mechanism for a producer to offset its collection and recycling targets – the same way that carbon credits work as part of greenhouse gas mitigation strategies.

At the country level, it’s also conceivable that the Plastic Standard could be adopted by local governments and municipalities as a broader “plug and play” framework for the regulation and monitoring of its EPR framework.

Global Plastic Treaty

The United Nations Environment Assembly has the commitment of 193 parties to negotiate a Global Plastic Treaty by November 2024 that will address the full life cycle of plastic, including single-use plastics and microplastics (see our recent blog about the UN Global Plastic Treaty for more details). The treaty will be analogous in structure and intent to the Paris Agreement (and supplementary Glasgow Climate Pact) to limit climate change, with national action plans underpinning the plastic pollution mitigation targets set by each party.

An EPR framework would logically form the cornerstone of these national action plans, giving those parties with well-designed frameworks already in place a head start in this global effort. The Treaty will also contain an offset mechanism, allowing parties to trade plastic credits generated by certified plastic waste reduction projects.

All this points to a plastic stewardship pathway that is increasingly characterised by common concepts and tools: action on single use plastics, circularity in supply and design, mitigation targets that can be ramped up over time, and tradeable plastic credits to help companies and nations address plastic pollution efficiently and transparently.

Learn more about Extended Producer Responsibility, sustainability and plastic waste recycling news by subscribing to the Plastic Collective newsletter.