Carbon Credits: A Roadmap to Success

The carbon market provides an interesting starting point, it’s worth noting the success of the carbon credit market. The carbon credit industry has long been a leading example of how environmental credits can effectively address pressing global issues such as climate change and encourage a circular economy. With over 100 different methodologies under which different types of carbon credits may ultimately be certified and issued. This reflects the maturity of the carbon credit market, which came into being as a result of the United Nations’ Kyoto Protocol agreed in 1997. The Protocol enabled countries to create partnership to trade carbon credits as a way to reduce greenhouse gas emissions. In 2023, 164 million carbon credits were retired, and voluntary carbon market transactions alone (i.e. excluding mandatory markets) were valued at around USD 2 billion per annum.The Nascent Plastic Credit Market: Small but Growing

In contrast, the plastic material offsetting market is still nascent. There are presently 5 public methodologies under which different types of plastic credits may ultimately be generated and publicly traded, making the choice for brands, plastic producers and investors relatively simple. However, it is important to first understand the key differences between available plastic credits. A full analysis of available plastic credit methodologies was published recently by the World Bank. One of the most important assessment criteria is the allowable end of life for collected plastic waste through the plastics value chain. Those ends-of-life plastics that support full circularity of the resource that is post-consumer plastic being the best choice.End of Life: What Happens to Plastic After Collection?

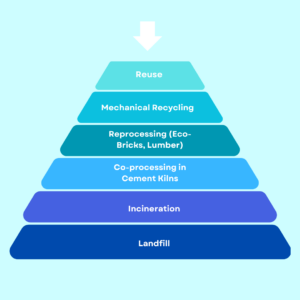

Different crediting methodologies allow different ends-of-life for plastic collection activity. End-of-life plastic refers to the final destination of the plastic waste that has been collected and it plays a crucial role in determining the sustainability of a plastic credit. Ideally, methodologies should support circular initiatives, environmentally friendly ends-of-life, such as reuse and advanced recycling such as mechanical . The hierarchy of these ends-of life plastics may be depicted as follows:

1. Reuse: The Ideal Endgame

At present, the concept of a plastic credit for upstream activities such as reuse is at a very early stage of consideration. Initial piloting has indicated that a significant level of effort would be needed to develop robust methodologies and establish a solid plastic crediting system that promotes upstream solutions. This is complete management of circular plastics.

2. Mechanical Recycling: The Front Runner

Mechanical recycling however is the most prominent acceptable end of life for several plastic credit methodologies, including those developed and implemented by Verra (Plastic Waste Reduction Standard) and Zero Plastic Oceans (Recycling Organisation Standard). Mechanical recycling supports circularity by enabling virgin plastic to be displaced by mechanically recycled plastic in almost all plastic products and packaging in market today, including packaging of the highest food grade quality.

The revenues being generated by the sales of these recycling credits are being used to finance further expansion in much needed global plastic recycling capacity. An estimated USD 1.5 trillion is needed to expand recycling capacity by 2040 to prevent plastic from leaking into the environment.

3. Reprocessing: A Mixed Bag

Reprocessing of plastic into composite materials such as bricks, lumber and particle board is the third most appropriate end of life, and one that is acceptable under many of the available plastic credit methodologies. Reprocessing generally sees the displacement of traditional materials such as wood by plastic content, which may yield environmental benefits. However, the Verra Plastic Standard recycling methodology does not permit reprocessing as an acceptable end of life unless it is displacing virgin plastic and therefore achieving true plastic circularity.

4. Co-processing in Cement Kilns: A Double-edged Sword

Next down the hierarchy is co-processing in cement kilns plastic waste (usually low-recyclability plastic) is burned instead of coal and gas to produce the energy required to make cement. The cement industry is a high energy intensity industry consuming around 15 percent of the global energy budget. Co-processing also releases harmful substances like dioxins and furans; if enough of those pollutants escape from a cement kiln, they can be hazardous for humans and animals in surrounding areas. The cement industry plays a central role in the economic growth of emerging nations.

The Philippines’ Case Study: EPR Legislation and Its Impact

The Philippines (classified as a Low-Middle Income Country by the World Bank) has a thriving cement industry. It is also one of the leaders in the implementation of Extended Producer Responsibility (EPR) legislation, based on the principles of circularity and ‘polluter pays’ which sets plastic recovery targets for plastic producers that ramp up from 40 percent in 2024 to 80 percent in 2028.

An innovative element of the Philippines’ EPR programme is that plastic material producers determine their own plans to meet these targets, and the purchase of plastic credits for target offsetting purposes is a permissible component of these plans. As a result, the Philippines has sparked the growth of one of the largest mandatory (i.e. driven by legislated EPR targets) plastic credit exchanges in the world to date, with up to 60,000 credits generated on one local exchange alone.

However, these mandatory credits are being generated for the large part via a methodology that permits cement co-processing as an end of life – a final destination just above landfill and incineration in the hierarchy. The unintended consequence is that the new revenue stream generated in the form of EPR credit sales is flowing directly to the Philippines cement industry, rather than promoting plastic circularity through funding the growth of the advanced mechanical recycling industry.

And these ‘cement kiln’ credits are selling for around USD 150/tonne, which does not align with the ‘polluter pays’ principle, under which plastic producers pay the full costs of their plastic production activities. This entails accounting for the negative environmental and social impacts of plastic pollution born by society as a whole, and not by the plastic producer. The ‘full cost’ of plastic pollution is estimated by the Economist Plastic Management Index to be approximately USD1,000/ tonne – so plastic producers in the Philippines are likely paying well below the true cost of their plastic pollution via the purchase of cement kiln credits to meet their mandated targets.

Addressing the Unintended Consequences of EPR Programs

The Philippines’ experience demonstrates that while EPR programs are valuable, there can be unintended consequences when the focus shifts away from circular plastic initiatives. Whilst there is clearly an important role for the cement industry in the Philippines and most other economies, the goal of EPR programmes is to improve circularity and reduce plastic pollution through financing expansion of plastic recycling capacity, therefore increasing recycling rates. The Philippines government has an opportunity now, as it moves into its next phase of EPR programme development, to address this unintended consequence and fully embody the concepts of circularity and ‘polluter pays’ in its programme. A pivot towards credit methodologies that support more circular ends-of-life could support this in both the Philippines and other countries where EPR programmes are being implemented.

Paving the Path Towards True Circularity

The road to achieving plastic circularity and a optimised plastic value chain is filled with challenges, but it’s not impossible. By choosing the right plastic credit methodologies and prioritising circular end-of-life solutions like reuse and mechanical recycling, we can make a real difference. The plastic credit market may still be in its early stages, but with careful planning and investment, it has the potential to become a powerful tool in the fight against plastic pollution such as single use plastic packaging.

As countries like the Philippines continue to refine their EPR programs, there’s a golden opportunity to shift towards more sustainable options that promote real circularity. The future of plastic lifecycles doesn’t have to be linear; together we can make it circular.